Digital Asset completed $135 million Strategic Round funding

Sector:

Fintech

Blockchain

Digital Asset

completed $135 million Strategic Round funding. Investors include

BNP Paribas, Circle Ventures, Goldman Sachs, Liberty City Ventures, Polychain Capital, 7Ridge.

Led by DRW Venture Capital and Tradeweb Markets, the round includes participation from major institutions in both traditional and decentralized finance, including BNP Paribas, Circle Ventures, Citadel Securities, The Depository Trust & Clearing Corporation (DTCC), Goldman Sachs, IMC, Liberty City Ventures, Optiver, Paxos, Polychain Capital, QCP, Republic Digital, 7RIDGE, and Virtu Financial. Yuval Rooz, Co-Founder and CEO of Digital Asset said, "This funding milestone validates the inevitability of what we envisioned years ago: a privacy-enabled public blockchain designed specifically for institutional adoption. Canton is already actively supporting numerous asset classes–from bonds to alternative funds–and this raise will accelerate onboarding even more real-world assets, finally making blockchain's transformative promise an institutional-scale reality."

About

Digital Asset is a leading innovator in blockchain technology, transforming traditional and digital financial markets with privacy-enabled solutions that improve capital flow and create a more efficient, fair, and resilient global system. As the creator of the Canton Network, the only public layer one blockchain with privacy, and a founding member of its Global Synchronizer Foundation, Digital Asset has been a pioneer of this open, secure, and interoperable infrastructure. Founded in 2014, Digital Asset is committed to reshaping the future of finance by enabling real-time efficiencies, 24/7 global transactions, and unlocking the full potential of cryptocurrencies, digital assets, and the continued convergence of decentralized and traditional finance.

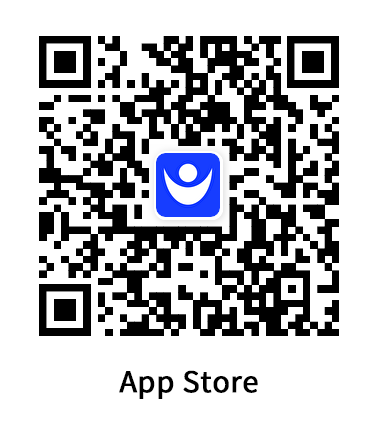

Download StockFan App

Ad

Stock market data, news and community, all integrated.

Features include real time stock quotes, interactive charts, technical signals, institutional & insider ownerships, stock screener, ETF rankings, SEC filings, press releases, videos, earnings calendar, social media posts, group chats.