Submit Deck

Become LP

Location:

660 Newport Center Drive

Newport Beach, CA 92660

USA

Newport Beach, CA 92660

USA

Investor Type:

Sector Focus:

Round Preference:

Investment Region:

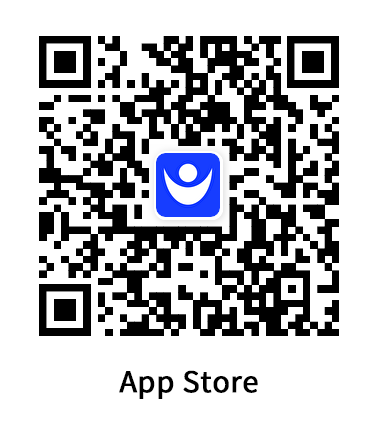

Download StockFan App

Ad

Stock market data, news and community, all integrated.

Features include real time stock quotes, interactive charts, technical signals, institutional & insider ownerships, stock screener, ETF rankings, SEC filings, press releases, videos, earnings calendar, social media posts, group chats.

About

We are a seed stage venture capital fund. As such, we make our initial investment into technology startups during their “seed phase” before they have established product-market-fit. What does this mean? This means we invest in start-ups looking for their first institutional money and, in some cases, their first outside money altogether. For example, most of the startups we have invested in have been pre-revenue when we made our initial investment.

Sectors of Interest

We currently invest in seed stage startups in both the enterprise and consumer technology sectors. In prior funds, we also invested in medical device and medical diagnostic startups. We have a particular fondness for multidisciplinary opportunities that capitalize on the convergence of multiple technologies. Please see our Portfolio for a representative list of our current investments.

Size

We prefer to invest in capital efficient technology startups and will typically invest $750K to $3M (on average) over the life of the company in which we invest.

Other Considerations

In addition to investing in the companies in the aforementioned sectors at the aforementioned stages, we have a particular emphasis on investment opportunities that are here in southern California. We truly believe that Southern California has all the raw materials necessary to be a thriving entrepreneurial ecosystem in and of itself.

Portfolio Companies

Team

I work here

Recent Investments