Submit Deck

Become LP

Location:

New York, NY

USA

USA

Investor Type:

Sector Focus:

Round Preference:

Investment Region:

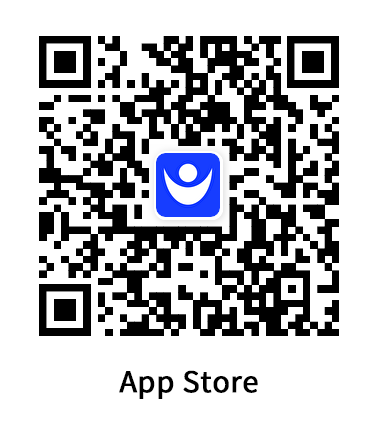

Download StockFan App

Ad

Stock market data, news and community, all integrated.

Features include real time stock quotes, interactive charts, technical signals, institutional & insider ownerships, stock screener, ETF rankings, SEC filings, press releases, videos, earnings calendar, social media posts, group chats.

About

Founded in July 2012 by a seasoned team of Silicon Valley innovators and Wall Street experts, Boardman Bay Capital Management (BBCM) is a leading investment manager specializing in both public and private equity. At the heart of our strategies is an immersive, on-the-ground research process dedicated to uncovering transformative trends and opportunities within the global technology subsectors.

Boardman Bay’s flagship—a sophisticated long/short hedge fund—strategically targets the dynamic global technology sector, leveraging accelerating advancements in Generative Artificial Intelligence (AI), Digital Transformation, and Hyperscale Datacenters. Boardman Bay also meticulously curates 'Opportunity Funds', concentrated portfolios that encapsulate our best ideas, deep sector expertise, and unique market opportunities. The Optical Opportunities Fund targets the optical component and semiconductor subsectors, which include much of the infrastructure required for advanced data centers, AI, and transformative power management. The optical industry is also undergoing rapid structural change through consolidation and the maturation of silicon photonics is driving an intense collision with the semiconductor sector.

Since 2015, Boardman Bay has invested directly in leading private companies through separately managed SPVs (special purpose vehicles). Boardman Bay Ventures has been an active investor, leading rounds, acting as a strategic advisor and board member across over ten separate investments and ‘Series’ funds. Notable investments include AYAR LABS, GROQ, CREDO (CRDO), ELENION and GRAB (GRAB).

In 2024, Boardman Bay is launching its first dedicated venture capital fund: Boardman Bay Venture Opportunities Fund, specifically targeting private “hard-tech” companies that empower the infrastructures required for Generative AI and hyperscale datacenters.

Team

I work here

Recent Investments