Submit Deck

Become LP

Location:

San Francisco, CA

USA

USA

Sector Focus:

Round Preference:

Investment Region:

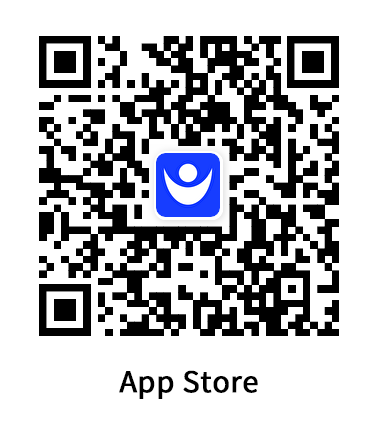

Download StockFan App

Ad

Stock market data, news and community, all integrated.

Features include real time stock quotes, interactive charts, technical signals, institutional & insider ownerships, stock screener, ETF rankings, SEC filings, press releases, videos, earnings calendar, social media posts, group chats.

About

3Spoke Capital (“3SPOKE”) is a private investment firm that provides structured secondary solutions to private market investors holding late-stage venture and growth equity assets; including venture capital fund limited partners, general partners, and technology-enabled company shareholders, who are seeking to generate liquidity from their assets while retaining both upside and flexibility.

3SPOKE’s solutions provide liquidity as an alternative to a sale where the shares, limited partner, or general partner portfolio interests are secured as collateral.

Utilizing an innovative preferred equity financing structure combining features of debt + equity, 3SPOKE invests in the next generation of visionary and disruptive global companies. These innovative companies continue to mature and grow larger and more valuable while remaining privately held, creating enormous pent-up demand for liquidity from their stakeholders. 3SPOKE’s mission is to provide balanced liquidity solutions for this dynamic ecosystem, while providing investors access to venture and growth equity no longer easily accessible through the public markets and represented by an extremely large and growing opportunity set.

3SPOKE offers its asset owners a highly favorable form of liquidity that allows them to continue to participate in future growth in value, without locking in current market discounts or taxes, or requiring a change in control; and offers investors a risk-mitigated approach to invest in the most successful private companies and portfolios containing them, while taking execution rather than concept risk, and benefiting from an asymmetric risk-return profile.

Portfolio Companies

Team

I work here

Recent Investments